“The Impact of Medical Necessity in 2020”

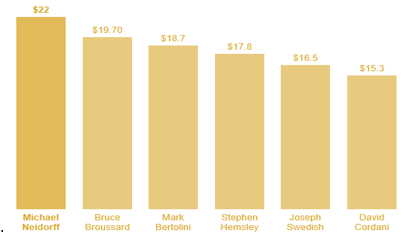

Ahh! “The Most Wonderful Time of The Year” or so they say. The question is, for whom is it really the most wonderful time of the year? If you are an insurance company depending on the recoupments and/or settlements you received in 2019 coupled with the denial of benefit payments for medical services needed by beneficiaries who pay their exorbitant premiums, it could be a very good year for bonuses. The average insurance executive salary is around $110,000 with bonus in the neighborhood of $32,000. Now, if you are one of the CEOs for a large insurance company like Centene’s Michael Neidorff, who earned $22 million in 2016, (which made him the highest paid of the 6 largest publicly traded health insurers based on the Securities and Exchange Commission) or Humana’s Bruce Broussard, who earned $19.6 million in 2016 (which was a $9.3 million dollar raise from 2015), it is a great year!

Here is a listing according to the SEC for the 2016 highest paid executives at the insurers.

Payers and Medical Reimbursements

Payers and Medical Reimbursements

I have been accused a time or two by some at the payers of painting them in a “Bad-Light.” I can assure you; they do not need my help with this as they do a perfectly fine job all on their own! Here’s the thing, everyone knows the games payers play with medical reimbursements and we expect it. Payers should embrace it I say, and be proud of the tactics deployed to turn a profit at all costs!!! It is critical to keep in mind that insurers are not in the business to pay claims for sick people; they’re in business to turn a profit since they are beholden to shareholders and the obligations to pay exorbitant salaries and big bonuses. And I am okay with them turning a profit but not at the expense of denying coverage for treatment for those who desperately need it or engaging in what can only be considered unethical and possibly illegal behavior to turn that profit. For years, I have discussed the importance if not the criticalness of establishing the “Medical Necessity” related to every service rendered patients and the consequences for failing to do so. In many of my Blog Posts, I have addressed medical necessity to ensure as you perform audits of your providers or update/create your internal policy regarding medical necessity that you have a strong foundation on which to build. Again, I will lay out here some of the foundation for the term and how it is viewed both in the legal community and at the insurers performing audits to determine whether to pay a claim or more importantly, whether or not they are going to allow you to hang on to what you have already been paid.

Let’s address the 800lb gorilla in the room; medical necessity and understand that the first definition I am sharing with you was based on national settlements. Insurers – Aetna, CIGNA, Health Net, Prudential, Anthem/WellPoint, and Humana entered into settlement agreements between 2003 and 2006 with over 900,000 physicians and state and county medical societies as part of the class action lawsuits consolidated as In re Managed Care Litigation in the U.S. District Court for the Southern District of Florida. It is important to note that other defendants including PacifiCare, United Healthcare, and Coventry refused to enter into settlement agreements and opted to address the matters as each saw/determined beneficial to them. (If you have not seen one of these settlement agreements, you can review one of them tied to CIGNA here, whereby they had to create a fund of $30 Million to compensate health care providers: https://www.cignaphysiciansettlement.com/documents/G539-2ndNoticeFINAL.pdf) For those of you not familiar with the litigation, the allegations made were based on the belief that dating back to the 90s all of the aforementioned insurers engaged in a conspiracy to improperly deny, delay, or reduce payment to physicians by failing to pay for “medically necessary” services in accordance with member plan documents (remember above I said some of the payers accuse me of painting them in a bad-light? Again, they didn’t need my help as they accomplished it all on their own!). One of the main focuses of the settlement agreement was that each company agreed to accept a definition of medical necessity, which is provided below and varies little between the payers.

Importance of “Medical Necessity”

“Medically Necessary” or “Medical Necessity” shall mean health care services that a physician, exercising prudent clinical judgment, would provide to a patient to prevent, evaluate, diagnose or treat an illness, injury, disease, or its symptoms, and that are: a) in accordance with generally accepted standards of medical practice; b) clinically appropriate, in terms of type, frequency, extent, site and duration, and considered effective for the patient’s illness, injury or disease; and c) not primarily for the convenience of the patient, physician or other health care provider, and not more costly than an alternative service or sequence of services at least as likely to produce equivalent therapeutic or diagnostic results as to the diagnosis or treatment of that patient’s illness, injury or disease.

For these purposes, “generally accepted standards of medical practice” means standards that are based on credible scientific evidence published in peer-reviewed medical literature generally recognized by the relevant medical community or otherwise consistent with the standards outlined in policy issues involving clinical judgment.”

CIGNA was one of the companies who adjusted the definition slightly by removing the word “preventing.” Health Net and Anthem/WellPoint agreed to the definition specifically and only for clinical conditions and mental health care, including treatment for psychiatric illness and substance abuse. The agreements with Aetna and Humana did not limit the use of the term “preventing.”

Here is why the above is so important, the settlements have expiration dates and vary by company. This means that at some point these insurers will no longer be bound to follow the definition contained in the settlements and once again we can be returning to the Wild West. Research each one of the companies you participate with and understand the terms and length of time each is bound to the settlement agreement. If they opted out of the class, then research how each handled their cases and the outcome of it. Knowing the facts and what payers are bound to and for what duration is what protects you and your practice.

The second definition regarding “Medial Necessity” is from Medicare and it specifically states, “According to the Medicare glossary, medically necessary refers to: Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine.” Pretty broad right? Based on that, denials for services failing to establish medical necessity should be rare. However, if you look deeper in to the Medicare Program Integrity Manuals and specifically 30.6.1 – Selection of Level of Evaluation and Management Service (Rev. 3315, Issued: 08-06-15, Effective: 01-01-16, Implementation: 01-04-16) Medical necessity of a service is the overarching criterion for payment in addition to the individual requirements of a CPT code. It would not be medically necessary or appropriate to bill a higher level of evaluation and management service when a lower level of service is warranted. The volume of documentation should not be the primary influence upon which a specific level of service is billed. Documentation should support the level of service reported. The service should be documented during, or as soon as practicable after it is provided to maintain an accurate medical record.

Challenges with Documentation Requests

I, along with our team at DoctorsManagement, have seen no slow-down in the number of Additional Documentation Requests (ADRs) for Probe, Statistically Valid Sampling, or the Targeted, Probe and Educate program. In the past 30-days, we have received no less than a dozen new clients and a half dozen established clients reaching out for support through the process. When you receive your letter requesting/demanding copies of your medical records, you have to be ready. Timeframes for turning documents around are between 30 and 45 days depending on who’s asking (MAC vs. Contractor vs. Private Payor) and knowing your rights is critical. As an example, I have a new client that is going through the TPE process (Round 1) and they were notified that a letter requesting specific patients would arrive to them within 2-3 weeks. Well that is right at Christmas, so they asked for an extension and were told “Medicare no longer grants extensions.” Really??? When did that happen, because I request them and am granted them all the time. However, this LPN was insistent that an extension could not be granted for post-payment reviews. So, I asked her to provide that to me on CMS and her MAC’s letterhead and of course I didn’t receive it, but that was not the end of the discussion. 3.2.3.2 – Time – Frames for Submission (Rev. 628, Issued: 12-04-15, Effective: 11-16-15, Implementation: 01-06-16) This section applies to MACs, RACs, CERT, and ZPICs, as indicated. “B. Postpayment Review Time Frames When requesting documentation for postpayment review, the MAC, CERT and RAC shall notify providers that the requested documents are to be submitted within 45 calendar days of the request. ZPICS shall notify providers that requested documents are to be submitted within 30 calendar days of the request. Because there are no statutory provisions requiring that postpayment review of the documentation be completed within a certain timeframe, MACs, CERT, and ZPICs have the discretion to grant extensions to providers who need more time to comply with the request. The number of submission extensions and the number of days for each extension is solely within the discretion of the MACs, CERT and ZPICs. RACs shall follow the time requirements outlined in their SOW.” Now, if this was a prepayment review, the LPN would have been correct on not granting extensions since the system auto-denies on day 46 if documentation is not received.

The reason extensions are so important is we always want to make sure we are sending a complete and accurate representation of services rendered to limit an auditor’s ability to find fault and assess an overpayment. It also provides an opportunity for the practice to do a review of the documentation to ensure it is a true representation of services billed for and hopefully paid. Beyond that, extensions for review of medical record documentation is critical since the MACs have the power, based on CMS directive, to revoke billing privileges based on a determination that “the provider or supplier has a pattern or practice of submitting claims that fail to meet Medicare requirements.” 42 C.F.R. § 424.535(a)(8)(ii). This language demonstrates TPE audit findings could be used as a precursor for determining abuse of billing privileges leading to the removal from participation in the Medicare program. CMS’ guidance provides the MAC authority to refer providers for potential fraud investigation, based on review findings. This is why it is critical for providers to request and be granted extensions and to use that additional time judiciously to ensure the submission of documentation that builds a clear record to support claims and demonstrate compliance with Medicare requirements.

Preparing for the Future

As we close out 2019 and prepare for 2020, taking the time to understand the what, when, where, why and how things work from payer to payer and adapting your practice to these payers and their ways of conducting business will help you to remain in lock-step with them. Educate your staff and providers on the criticality of medical necessity and explain to them the importance of a strong History (Chief Complaint and History of Present Illness) and Assessment and Plan that ties back to the Nature of the Presenting Problem(s) to ensure each note stands on its own and that medical necessity is truly the overarching criteria in addition to the individual elements of the CPT code(s).

On behalf of myself and the entire DoctorsManagement family; we wish you a very Happy Holiday season and a Blessed New Year! My Blog Posts will resume in January 2020!!

Sean M. Weiss is a Partner and serves as VP/Chief Compliance Officer for DoctorsManagement, LLC based in Knoxville, TN. DoctorsManagement, LLC services more than 20,000 clients nationwide and has been in existence since 1956. Weiss serves as an Investigator and expert witness in Federal and State cases as well as an expert or lead in Administrative Law Judge Hearings. During his 25-year career, Weiss has engaged in more than 200 cases working with law firms and health systems across the country. Weiss serves as a third-party compliance and regulatory officer for more than a dozen healthcare organizations across the country of varying sizes. For more information on Sean M. Weiss or DoctorsManagement, LLC visit us online at www.doctorsmanagement.com or contact us directly at 800.635.4040. You can also follow Sean on his biweekly Blog on LinkedIn (Sean M. Weiss “The Compliance Guy”) or at www.thecomplianceguyblog.com

What to do next…

- If you need help with an audit appeal or regulatory compliance concern, contact us at (800) 635-4040 or via email at [email protected].

- Read more about our: Total Compliance Solution

Why do thousands of providers trust DoctorsManagement to help improve their compliance programs and the health of their business?

Experienced compliance professionals. Our compliance services are structured by a chief compliance officer and supported by a team that includes physicians, attorneys and a team of experienced auditors. The team has many decades of combined experience helping protect the interests of physicians and the organizations they serve.

Quality of coders and auditors. Our US-based auditors receive ongoing training and support from our education division, NAMAS (National Alliance of Medical Auditing Specialists). All team members possess over 15 years of experience and hold both the Certified Professional Coder (CPC®) as well as the Certified Professional Medical Auditor (CPMA®) credentials.

Synergy – DoctorsManagement is a full-service healthcare consultancy firm. The many departments within our firm work together to help clients rise above the complexities faced by today’s healthcare professionals. As a result, you receive quality solutions from a team of individuals who are current on every aspect of the business of medicine.